Money Talk: Are Your Expenses a Lifestyle Choice or a Necessity?

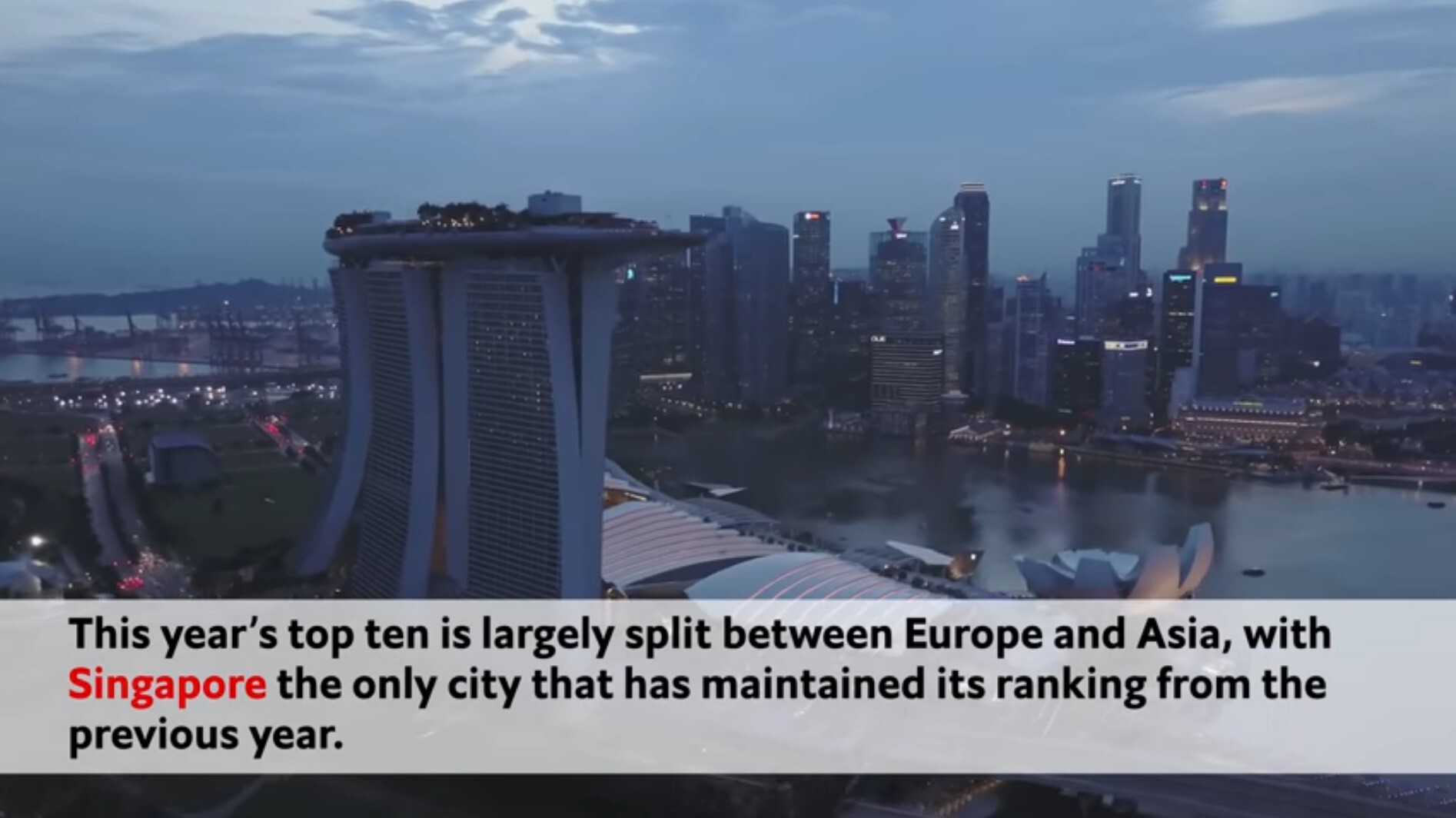

Singapore was the world’s most expensive city to live in from 2014 to 2019 according to Worldwide Cost of Living, a survey done by the Economist Intelligence Unit (EIU). While the city-state’s position dropped a bit when the pandemic hit, it still ranked fourth (or technically second because Switzerland, France, and Hong Kong shared the top spot) in 2020.

With the high cost of living, a lot of us are wondering if it’s possible to save up and be financially stable for the years to come. There’s no shortcut or one-way approach to it, but we can start by looking at what we do with our money.

The Food and Drinks We Consume

Buying food is a necessity. We need to eat to live, but not all of us have equal access to food. Some get by with eating fast food, while others can afford meals at fancy restaurants. We’re not saying you shouldn’t support your local food and beverage services (F&Bs), but cooking more at home can help you save because you can control the portions and make food that’s good for a few days.

The same goes with your drinks. Let’s say you start your day by buying an Americano at a nearby café before going to work. It has become your routine for years and your body has been conditioned to look for a caffeine fix as if it’s an “on” switch. Now that you’ve experienced being stuck at home due to the pandemic, do you still order coffee before work?

There’s nothing bad about buying coffee in the morning to wake yourself up, but it doesn’t have to be every day. True, it has been part of your routine, but there are other options if you truly want to save. If you make it a lifestyle choice to “make” instead of “buy” a cup of coffee, you’ll have some extra money that you can put in an emergency fund.

The Items We Checkout

In a report by Finder Singapore, a 2020 survey revealed that 38% (or 1.1 million) of Singaporeans have used a Buy Now Pay Later (BNPL) service and that 27% of them have taken a financial hit after using it. Across age groups, those aged 16 to 44 years old have used BNPL the most. What’s alarming is that a majority of them used BNPL after an impulse purchase.

BNPL makes you feel like you can afford things, even those that you don’t actually need. You’ll only realise your mistake once it comes back to bite you. What’s worse, the spark you felt after checking out could die down after a few days or weeks. That new item will give you a sense of gratification upon arrival, but would that feeling last long enough until you make a complete payment? It’s possible for that item to eventually become a bitter reminder of the bills you have to pay.

Online shopping has become a necessity when the pandemic hit, but it’s a lifestyle choice if you buy something that isn’t within your means.

Nobody is forcing you to stop buying the good stuff, but it would be best to learn how to control your spending habits. The next time you add to cart or bring out your wallet, won’t it be a good start to ask yourself: Is it a lifestyle choice or a necessity?

Subscribe to The Beat's newsletter to receive compelling, curated content straight to your inbox! You can also create an account with us for free to start bookmarking articles for later reading.