GInvest Review: What We Learned (and Earned) After Using GCash’s Investment Platform

Thinking of where to put your 13th month pay? Ready to go out of your comfort zone and invest in something riskier for potentially higher returns?

In March 2021, GCash rolled out GInvest, an in-app marketplace that aims to laymanize investing for Filipinos. As a curious cat, this writer tried investing in two funds on GInvest last August. And after nearly two months, here’s what we have to say about this platform.

What is GInvest

GInvest is a digital investment platform within the GCash app. Its claim to fame is attributed to having affordable products that let anyone who has a GCash account invest in equities and bonds for as low as P50. That’s not even half of what you’d typically spend on iced coffee or milk tea! As of writing, there are five funds available on GInvest—all managed by ATR Asset Management Group (ATRAM) in partnership with Seedbox Philippines.

GInvest essentially falls under Unit Investment Trust Funds (UITF), which are a pool of investments in company stocks or bonds handled by professional fund managers. For this review, we tried ATRAM Global Technology Feeder Fund, a pool of funds that invest in foreign technology companies such as Microsoft, Apple, Visa, and Samsung, as well as ATRAM Philippine Equity Smart Index Fund, which is composed of the 30 companies that make up the Philippine Stock Exchange index.

You can also choose funds that invest in foreign consumer companies, as well as Philippine government and corporate bonds.

How to Invest in GInvest

One of the things that bar people from investing in stocks or equities is the idea of having to go through paperwork. GCash knows this pain point and has made it convenient for anyone to access their investment platform through their app.

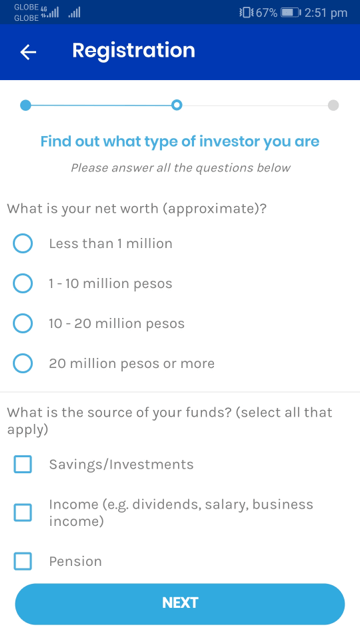

Once logged in, click View all GCash Services and choose GInvest under Financial Services. This will lead to a Risk Profile Assessment, a set of questions to determine your risk tolerance (conservative, moderate, aggressive).

After that, you will be redirected to a page that displays all five products on offer under GInvest. You can click on each to see the fund’s description, performance over the past 12 weeks, and minimum initial investment.

Click Buy to invest in a certain fund, read the disclaimer documents, and check the three boxes if you agree. Make sure that your GCash has enough money to cover your fund purchase. Once done, click Submit and wait for three to four days for the funds to reflect on your account.

Pros of GInvest

- It’s affordable. The minimum investment for local bond and equity funds is P50; for funds that invest in foreign companies, the starting amount is P1,000.

- It’s convenient. The only requirement for GInvest is to have a verified GCash account. Oh, and you should be at least 18 years old.

- GInvest is built in within GCash so you don’t have to download and install a separate app.

- Because it is built within the GCash app, all your transactions are in sync. You will receive a confirmation text message for every transaction, allowing you to keep track of all your orders at once.

- No fees. As of writing, GInvest does not charge any transaction fees when you buy or sell funds. Here’s the caveat: GInvest’s partners charge an annual management fee, which is computed and incorporated into the daily net asset value per unit (NAVPU) and market value of your investments. It’s similar to broker’s commission when you do stock trading.

Cons of GInvest

- The waiting time. You have to wait for three to four banking days before an order is reflected in your account. For example, if I buy funds in Global Technology Feeder Fund on Sept. 20, that order will only be reflected in my account by Sept. 24. For the Philippine Equity Smart Index Fund, the waiting time is a tad shorter at three banking days.

(Note: The NAVPU is the prevailing market price the next banking day after you placed your order. Cut-off for all orders is between 12 AM and 11:59 PM.)

- You can’t see how many units you own, unless you manually compute it.

- You can’t access GInvest if GCash is down.

How Much We’ve Earned

Now, off to the best part: how much have we earned after a few weeks of investing via GInvest?

We invested P2,100 in Philippine Equity Smart Index Fund on Aug. 27; as of Oct. 23, the fund’s total market value is P2,225.98. That’s a gain of 125.98 pesos within almost two months. As of writing, the year-over-year (YOY) return of Philippine Equity Smart Index Fund is 14.19%.

Separately, we invested P7,500 in Global Technology Feeder Fund on Sept. 16; as of Oct. 23, the fund’s total market value is P7,770.84, translating to a profit of P270.84 in more than a month. The YOY return of Global Technology Feeder Fund is currently at 45.61%.

In comparison, a traditional savings account in the Philippines yields an interest of 0.25% to 2.5% per annum. Of course, there is far less risk when you park your money in your bank versus investing it in other vehicles.

Is It Worth Investing in GInvest?

Between the two funds, the Technology Feeder Fund is deemed more aggressive. We saw it lose more than P100 in a single day and while that isn’t a lot in conventional terms, it’s enough to say that this fund isn’t for the faint-hearted. It’s also worth noting that any decline in your fund’s market value is considered paper loss, unless you decide to sell your units. Had we sold our units at a discount, we would have incurred an actual loss. That’s why it’s important to determine your investment horizon before shelling out cash. It’s also not advisable to treat GInvest as an emergency fund given the time it takes to process every transaction. Overall, if you have extra cash to spare and can tolerate drastic price movements, we think GInvest is worth giving a shot.

Subscribe to The Beat's newsletter to receive compelling, curated content straight to your inbox! You can also create an account with us for free to start bookmarking articles for later reading.