Louder Connect: What Do Investors Look For in a Business Pitch?

You’ve been sitting on a golden egg for quite some time now, pouring blood, sweat and tears into an idea that you have unbridled confidence in - now all you must do is get it to hatch. Whatever stage you’re at on your entrepreneurial journey, there is no doubt that you will be facing an innumerable barrage of hurdles to turn your ideas into a reality.

November 2023, LOUDER Global by Yamilette Cano presented the first ever LOUDER Connect event: Radical Debates™, an open dialogue attended by a rush of industry experts.

With the combined experiences and perspectives of each speaker, Radical Debates™ delved into the complex interplay of female-led businesses, funding, and investment culture that goes on to shape the careers of female entrepreneurs.

Ranging from female entrepreneurs, marketers, and venture capitalists, the diverse group of panellists sat together to unravel the nuanced question of what investors look for in a business pitch, and whether or not that answer changes depending on who is pitching.

And why should this matter to you? According to the Global Entrepreneurship Monitor (GEM), there is a significant gender gap in established business ownership – with only one in every three entrepreneurs being a woman. This disparity lends itself well to being an open case study for entrepreneurs of all ages and sexes to learn from a minority group of business leaders to see where their priorities lie when it comes to running a business.

What can we learn from women in business

Having recently begun his entrepreneurial career, Nigel Smith (Founder & CEO, Nigel Smith Associates) moderated one of the panel talks and was delighted by what he was able to gain from the discussions.

“I’m going to pull out my notes!” he grins, as he unfolds a piece of paper brimming with bullet points and paragraphs written in blue pen. “What’s interesting is that some of the things I was learning is that it’s not easy… but, there is a clear way forward.”

He cites that work-life balance was one of his main takeaways from listening to the panel, coupled with the business aspects of the resilience and grit required to take your business to where you want it to go. He had observed that the female entrepreneurs on the panel emphasized the importance of nurturing trust in your networks, inner team and how to match budgets to their scope of services.

“[Another key point is] the ability to make decisions on your own or not on your own, some were [representing their business as] individuals and some were paired – it’s not too different from the big corporates, but it’s that you’ve decided to go on your own, so you have to be comfortable to a degree. Like me, I want to go alone – so, I’m going alone.”

Statistics on why we should invest in women

A 2019 Harvard study documented that most woman-owned businesses do not get funded by venture capitalists due to conscious and unconscious gender biases, endorsed by a lack of female representation on the investing side.

However, research shows that women-led businesses deliver higher revenues, equating to more than twice as much per dollar invested in 2018, with women-founded companies as far back as 2015 outperforming male-led companies by a whopping 63%.

As Carla Martinesi (Founder & CEO, CHOMP), puts it “I’m not saying that CHOMP is going to change the world, but it can open the door for other women to realize that there are solutions out there that can change the world. Most women have innovative ideas to solve problems, they are the ones who need to be listened to.”

The pervasive postulation that women-led businesses that have been able to find financial backers achieve this goal in spite of existing gender biases, leads to the assertion that it’s because they have a more robust product and business pitch to overcome such biases in the early funding stage.

“Listening to my panel that I moderated,” says Nigel, “it didn’t sound like any of [the female panellists] talked about the difficulties, as much as I was trying to lead it that way. So, it must come down from both sides.”

“I haven’t been a woman on the asking side,” he smiles self-evidently, “but I can only imagine that if I’m a businessman looking at great concepts, is it a ‘Best in Class’ decision or is it a ‘Man versus Woman’ decision?”

While we don’t have all the answers, the incentive to invest in women-led businesses is not limited to increased profits. Real-world benefits can also include overall job satisfaction, as found by the Journal of Organizational Behaviour – which cites that half of Americans would prefer to work for female-led companies as they can be more purpose-driven. In addition to this, the future of the global economy hinges on representation of women in the workforce catering to other women. Should exclusionary hiring practices continue, there is an estimated loss of up to US $1 trillion by 2030.

What investors are looking in a pitch

Bowie Lau (Founder, MaGEHold) sits on the other side of the table, with entrepreneurs pitching to her for investments. When asked about whether or not she would be more inclined to invest in a male-led business over a women-led business, she waves a figurative hand in the air.

“I don’t really care. To me, it really depends on the business idea, the model, the opportunities in the space, and whether or not they have a unique selling point.”

For her, it is far more important to look for whether or not the pitching entrepreneur is a solo founder or it they have a co-founder.

“It’s a very lonely journey, there are many ups and downs. So, if you don’t have somebody to fight along with you, the success rate is going to be a lot lower. Doesn’t matter as long as there’s two people, ideally more [because] there are many roles to fill.”

Other basic checkpoints that she adheres to for the venture capital (VC) that she is involved with include serial entrepreneurship. “You must be a serial entrepreneur before you approach the VC fund for funding opportunities,” she adds as a second point, “You must reinvest from your own pocket. You got to have skin in the game.”

In part, to show your commitment and persistence for your own venture, putting your money where your mouth is, so to say – because at the root of it all, you should believe in your business more than anyone else.

How to make yourself stand-out

Last but not least, standing out when pitching your business idea and marketing yourself are integral to giving your business the best chance of taking off.

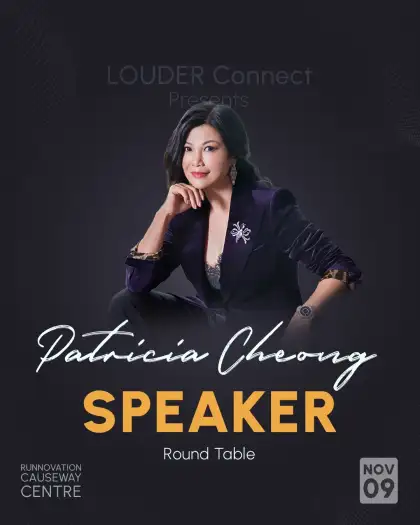

Patricia Cheong (Founder, MM Group) says that she makes use her own resources and networks to find a blind-spot in the industry, where her business has the best chance of success.

“The [business] idea is simple,” she says with an assured smile, “I learnt how to extend my network in the lifestyle community and be creative, to be able to provide something that they don’t have, that they want to have.”

For Carla Martinesi, it all comes down to being memorable – because in her own words. “Why not, what do you have to lose?”

“My pitch deck is fully pink. It’s not even my favourite colour, but I have gathered all the attention in the room by simply going through a deck that just looks ridiculous. Out of these pitching competitions, we have landed other vendor contracts, [opened] doors to hotels and airlines – so even if we didn’t win the actual thing, it’s left such a memory, which helps very much.”

Rounding up industry leaders, entrepreneurs, and VC investors in one room is no small feat, allowing attendees to glean from the learned experiences of members in specific sectors to carry forward in their own ventures. Seeded by the diversity in thought amongst the panellists, LOUDER Connect’s Radical Debates™ is the perfect sounding board for all entrepreneurs, no matter the industry.

To hear more perspectives from the event, check out our full round up here. Visit https://www.louderconnect.com/ to keep up with LOUDER’s latest thought-provoking events.

Get the latest curated content with The Beat Asia's newsletters. Sign up now for a weekly dose of the best stories, events, and deals delivered straight to your inbox. Don't miss out! Click here to subscribe.